Table of Contents

- How To Create Skrill Business Account

- Skrill Business Account Registration Sign Up

- Skrill Business Account Registration Login

- Skrill Business Account Registration Fees

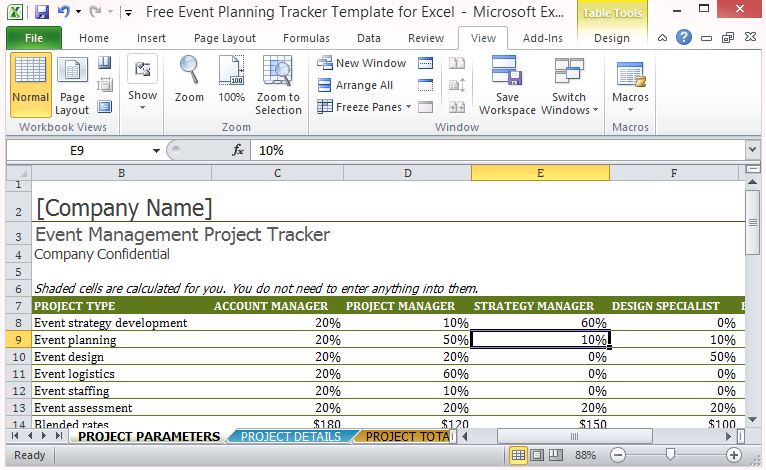

There should be no problem if you use a different currency for your Skrill account, for instance, your account in the. Registration of bank cards. How to Create Skrill Business Account, how to open verified business skrill account in Nigeria free, Buy Skrill business Account with documents.

PSD2 Terminology, Actors and Roles

European Payment Services Directive 2015/2366 (also known as PSD2) Defines the following actors and roles:

Payment Service User (PSU) - PSUs are the end-users of the services provided by TPPs and ASPSPs. They are either physical persons or entities (organisations, companies, administrations…).They do not interact directly with the PSD2 API.

Account Servicing Payment Service Provider (ASPSP) - These are Payment Service Providers (PSPs) which are in charge of holding payment accounts for their customers (PSU).

Third Party Provider (TPP) - These actors can intermediate between PSUs and ASPSPs, acting on behalf of PSU. Depending on the services they provide TPPs fall in one of the following categories;

- Account Information Services (AISP role) will allow the PSU to get information, through a single interface, about all of his/her accounts, whatever the ASPSP holding this account.

- Payment Initiation Services (PISP role) for requesting a Payment Request approval by the PSU and requesting the subsequent execution through a Credit Transfer.

- Card Based Payment Instrument Issuers (CBPII role) that will check the coverage of a given payment amount by the PSU’s account.

Skrill acts as Account Servicing Payment Service Provider (ASPSP) in PSD2 terms.

Skrill Payment Service Directive Compliance

In compliance PSD2, Skrill provides Modified Customer Interface (Mobile APIs) to qualified Third Party Payment Service Providers for the following purposes:

- Account and Transaction Information for Account Information Service Providers (AISPs)

- Payment Initiation for Payment Initiation Service Providers (PISPs)

Card-Based Payment Instrument Issuers (CBPIIs) use cases are not supported by Skrill

The APIs are Modified Existing Customer Interfaces fulfilling the following PSD2 requirements:

- API access is restricted only to Qualified Third Party Providers.

- TPP API access is restricted to their respective regulated roles

- Access to PSU account and data from TPP requires explicit user conscent, that can be revoked

- Transaction operations require Strong Customer Authentication

Qualified Third Party Providers

In the context of PSD2, being a qualified Third Party Provider (TPP) means:

- Having obtained the authorization from a National Competent Authority (NCA) to operate as a Payment Services Provider, with the roles it requires (AISP, CBPII, PISP). The list of National Register entities can be found on the Open Banking Europe Website.

- Having obtained from a Qualified Trust Service Provider (QTSP), Qualified Website Authentication Certificates (QWAC) and Qualified Sealing Certificates (QSealC), that have a PSD2 eIDAS certificate profile. Details on Qualified Trust Service Providers and the PSD2 eIDAS certificate profile can also be found on the Open Banking Europe Website.

Skrill supports only Qualified Website Authentication Certificates (QWAC) certificates for API access

In order for a third party to qualify for production API Access, both steps must have been completed and they must have matching data (the NCA delivers a registration number that must written in the certificate data).

It is possible for a qualified third party to lose its qualification, either because the certificate becomes invalid, or because the NCA decides to revoke the TPP’s authorization.

Third Party Provider OAuth client registration

In order to access Skrill APIs, the Third Party Providers are required to register OAuth 2 Clients for their applications.Registration and management of OAuth 2 Clients is provided by PSD2 OAuth2 and Client Management APIs.

Client Management API calls require mutual TLS authentication, with a Qualified Website Authentication Certificate (QWAC) issued to the TPP by a Qualified Trust Service Provider.

Client registration is performed through POST request on /psd2-oauth2/v1/registrations resource in Client Management API Endpoint with JSON body containing the following properties:

- client_name - A human-readable name for the client, that will be shown to the user during the consent process.

- scope - REQUIRED A space-separated list of scopes, that the client has (or requests) access to. In a PSD2 context, the following values are available:

aisp- Account Information and recent transaction history APIspisp- Payment Initiation service providers use cases APIscbpii- Card-based payment instruments issuers use cases APIs

- logo_url - OPTIONAL URI string that specifies a logo for the client, as a data scheme URI. If available, the data will be used to show the user a logo during the consent process.

- token_endpoint_auth_method - Token endpoint authentication method. Use

urn:paysafe:oauth:token-endpoint-auth-method:eidas-qwac:psdhere. - redirect_uris - REQUIRED A list of HTTPS URLs that describes the redirection endpoints for the client.

- grant_types - REQUIRED Restricted to

authorization_codeandrefresh_token. Other grant types are not supported in a PSD2 context. - response_typesREQUIRED - Use

codeas a value here. - jwks - A JSON Web Key Set object, that describes the public keys and certificates related to the given client. In the scope of PSD2, the JWK Set must be the set of Qualified Sealing Certificates (QSealC) that can be used by the client to sign requests.

Further detailed documentation can be found in PSD2 OAuth2 and Client Management APIs Documentation.

Authentication and authorization flow

Authentication and authorization is implemented as specified in OAuth 2.0 Authorization Code Grant flow RFC 6749.

The essential prerequisities for setting up the authorization flow for TPP applications are the following:

- OAuth 2 Client must be registered for the TPP applicaion

- TPP application must integrate with the PSD2 OAuth2 Authorization server and Token endpoints.

- Use of the OAuth 2 PKCE extension is mandatory, with the SHA-256 method

The detailed authorization flow proceeds as described in the sequence diagram:

- From the Third Party Provider (TPP) website/application, the Payment Service User (PSU) triggers the authorization process in order to allow access to his Skrill account resources

- The TPP website/application redirects the browser to the ASPSP (Skrill) OAuth 2 authorization server, with the required OAuth 2 client parameters

response_type- Equals tocodeclient_id- The OAuth Client ID registered by TPP during onboardingscope- The desired access scope. The scope must be one of client scopes defined during client registration.redirect_url- The redirect url provided by TPP, to which to return the authorization code.state- The TPP session state parametercode_challenge- SHA-256 code challenge parameter as defined in section 4.2 of OAuth 2 PKCE extension

- The ASPSP (Paysafe) OAuth 2 authorization server provides the user login and conscent interface. At this point the Payment Service User, must authorize the Third Party Provider.

- The browser gets redirected back to TPP redirect URL with the authorization

codeandstaterequest parameters - Third Party Provider (TTP) application uses the authorization code and PCKE secret (code_verifier) to obtain access and refresh token from OAuth authorization server. The following parameters are passed to the OAuth Authorization server

client_id- The TPP OAuth 2 client idclient_secret- The TPP OAuth 2 client secretgrant_type- Useauthorization_codeas valuecode- The authorization coderedirect_uri- Should match the OAuth client redirect urlcode_verifier- PCKE code verifier

- Refresh token can be persisted by TPP application and used for re-issuing access tokens as specified in Section 6 of RFC6749. Access tokens obtained in this way only provide access to information for which an SCA is not necessary.

- Payment Service User uses the related TPP functionality, that requires ASPSP

- TPP can access the corresponding ASPSP (Skrill) APIs on user behalf using the obtained access token.

Strong Customer Authentication

Strong customer authentication (SCA) is a requirement for payment actions. Upon initiation of money transfer, the transfer will get SCA challenge in the response and can not be finalized until SCA challenge is resolved by the user.

One time password generation is triggered and send directly to the user according to his account configuration. The OTP is passed over from the user to the Third Party Provider and used to confirm the OTP challenge. After that the transaction can be finalized.

User presence and offline account access

TPPs are required upon calling Skrill APIs for AISP and PISP use cases to attach PSU original IP Address as HTTP header.

The following HTTP header should be present and carry the PSU origin:

- PSU-IP-Address

The absense of the PSU IP address is interpreted as TPP accessing user data without user presence and such calls are subject to the following restrictions

- AISP shall not access PSU account data in unattended mode more than 4 times in 24 hours unless it has collected the user consent for that.

Account Information Services APIs

The APIs allow accessing PSU Account and Transaction History information using the below listed APIs.

The APIs requires one of the following scopes:

aisp- Allows accessing customer account information and recent transaction history

Payment Initiation Services APIs

The APIs allow performing transactions to other Skrill Accounts.

The APIs requires pisp scope for access. During money transfer SCA challenge will be triggered.

Card Based Payment Instrument use cases support

Skrill Mobile APIs does not provide dedicated api for funds confirmation.

API Documentation and Support

Server API endpoints can be found in their respective API reference documentation:

For support contact Skrill integration support team at integrationsupport@paysafe.com

Skrill is part of the PaySafe group and offers online payment facilitation to millions of users around the world. This payment method is fantastic if you want to bet on eSports and most of the platforms that cover eSports gambling also accept these payments. This guide looks at betting sites that accept Skrill in the USA and provides information on how to create an online account and then start using it to bet on your favorite eSports games and competitions. Thunderpick esports betting one of the sites that accept Skrill.

A Brief History Of Skrill

Skrill was originally known as Moneybookers and was first established in 2001. In 2007, Moneybookers was bought by Investcorp and then was rebranded as Skrill in 2013. Since then, Skrill has grown hugely in popularity and now has an immense user base around the world. Skrill offers a streamlined procedure and service to too dissimilar from PayPal. When using this platform you have the following benefits:

– No charges for credit card processing

– Borderless service i.e. easy cross-border payments

– Convienient deposit and withdrawal methods

– Smaller transaction fees compared to other provider

– Supported worldwide by a huge number of companies/websites

How To Create Skrill Business Account

As you can see, this payment platform certainly has a great deal to offer. If you want an alternative online payment method that is reliable, safe and straightforward, Skrill is certainly a great choice. Check out the egb betting review to learn more about the system of bonuses and payment methods.

Why is Skrill Suitable for Esports Betting?

eSports betting means big business in today’s online world. Online games such as League of Legends, Counter Strike and NBA2K now have huge competitions that are held around the world. Professional gamers enter these tournaments to compete against other teams and to win cash prizes. eSports is popular in many countries and gamers can actually make a living from doing what they love, much in the same way that athletes and sporting personalities can do.

Skrill and eSports go hand in hand – the two work well together, especially for eSports betting. This payment platform as you will see below is accepted by many online gambling sites. Furthermore, Skrill is easy to use and can allow people to deposit money and make bets on eSports game in a matter of minutes. It is this wide acceptance on betting sites that accept this platform, together with the convenience and ease of use, that make it such a suitable platform for online game betting.

How to Use Skrill to Bet on eSports

Now that you understand a little more about this payment system and its benefits for eSports gambling, we can look at how you actually use Skrill. The following are three steps you can follow to create a Skrill account, deposit cash, and choose an eSports website to gamble through:

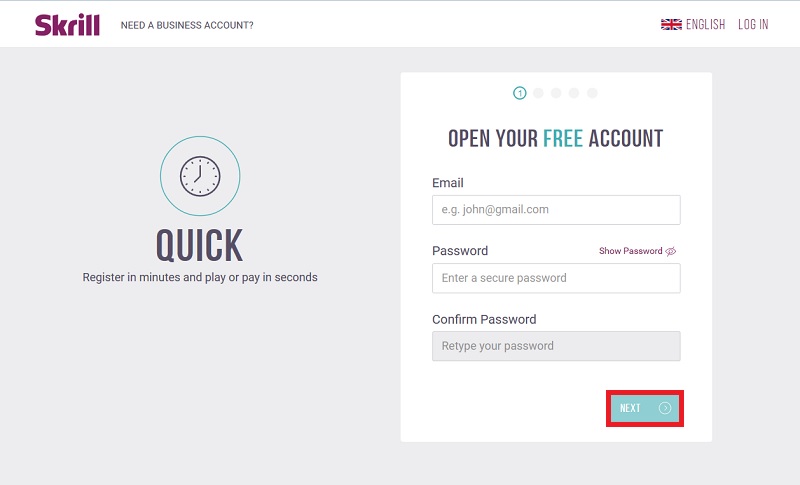

Step 1 – Create an account with Skrill

To start online betting with Skrill you must first register an account in a similar method to PayPal. Simply head on over to the Skrill website and click on Sign Up. From there you will have to enter several sets of information including a valid email address, you full name, D.O.B and also a valid address. Once you have completed the registration process you will have to validate your account through an email link. Finally, you will have to choose a method of authentication every time you logon – either using an authentication app or a mobile 4 digit code. The process takes maybe 5 minutes to complete.

Step 2 – Deposit cash into your Skrill account

Once you have successfully registered an eSports account you must then credit your account with funds. Skrill accepts several different payment methods and most credit your account instantly which is fantastic if you want to make a quick eSports bet.

The current accept methods of payment include – Rapid Transfer, Trustly, Bitcoin, Fast Bank Transfer, Pay Safe Card, Neteller, Credit of Debit card and Manual Bank Transfer. Every payment method except credit/debit and manual bank transfer have a maximum upload amount. Currently at this point in time, depositing cash into your Skrill account is completely free and there are no transaction fees. Once you have succesfully deposited money into your account you can then use it for payments through websites and systems that accept it.

Skrill Business Account Registration Sign Up

Step 3 – Find Skrill betting sites usa that support eSports gambling!

Skrill Business Account Registration Login

Now you have finished the boring part of account creation, you can start the fun part – finding eSports websites to gamble on! eSports is becoming hugely popular around the world, and as you would expect, online gambling companies have tapped into this lucrative market. You can find a number of different Skrill betting sites that support eSports – these sites allow you to bet on awesome games such as League of Legends, Counter Strike, DOTA2 and NBA2K. The following are some of the main platforms that support Skrill and offer eSports gambling:

– BetOnline.ag – (LOL, CS, DOTA2, SC, HotS)

– GGBet.net – (LOL, CS, DOTA2, SC, SCII, HotS, NBA2K)

– William Hill – (LOL, CS:GO, FIFA)

– Bets On – (LOL, CS:GO, DOTA2, Overwatch, RL, SCII)

– Arcane Bet – (LOL, DOTA2, CS:GO, HotS, Hearthstone, Overwatch, SCII, Halo, CoD)

All of these platforms offer an extensive range of eSports bets and all accept Skrill as a valid form of payment. Once you have chosen a Skrill eSports site of your liking, you can then deposit some cash from your Skrill account and start gambling!

Skrill Business Account Registration Fees

We hope you have found this guide useful. There are many betting sites that accept Skrill, especially those with support for eSports. Why not register your own Skrill account today, pick out a couple of awesome matches from League of Legends and Counter Strike and see if you can win big?